The Debt Trap: A Threat to Africa’s Future

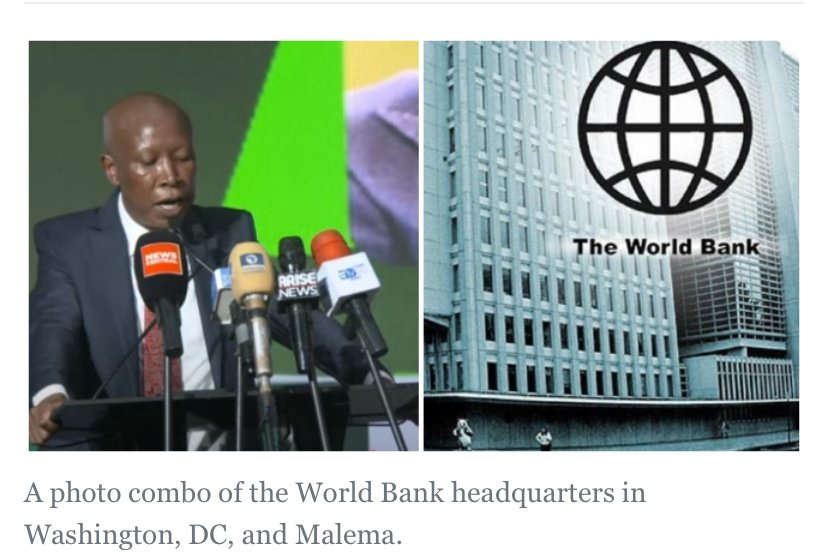

Julius Malema, the leader of South Africa’s Economic Freedom Fighters (EFF), has sounded the alarm on the dangers of “debt trap” loans from international financial institutions like the World Bank and the International Monetary Fund (IMF). Speaking at the Nigeria Bar Association’s Annual General Conference, Malema warned that these loans can mortgage Africa’s future and undermine the continent’s progress.

Malema’s concerns are timely, given the growing debt burden faced by many African nations, including Nigeria and Ethiopia. Unregulated borrowing from foreign lenders can lead to a vicious cycle of debt, where countries struggle to repay loans and are forced to accept stringent conditions that compromise their sovereignty.

The EFF leader highlighted the importance of regulating foreign loans, citing the Public Finance Management Amendment Bill introduced in the South African parliament. This bill would require the National Treasury to seek parliamentary approval before sourcing foreign loans, ensuring transparency and accountability in the borrowing process.

– Malema warns that “debt trap” loans from international financial institutions can undermine Africa’s future.

– Unregulated borrowing can lead to a vicious cycle of debt and compromise national sovereignty.

– Regulating foreign loans is crucial to ensuring transparency and accountability in the borrowing process.

– The EFF’s proposed bill in South Africa aims to checkmate unregulated borrowing and promote responsible financial management.

As African nations navigate the complex landscape of international finance, it is essential to prioritize responsible borrowing practices and ensure that loans are used to drive sustainable development, rather than perpetuating debt traps. By regulating foreign loans and promoting transparency, African countries can protect their interests and build a more resilient future.